san antonio tax rate 2021

Box is strongly encouraged for all incoming. The December 2020 total local sales tax rate was also 8250.

Solved 500 000 Operating Income From A Business Dividend Chegg Com

PersonDepartment 100 W.

. This is the total of state county and city sales tax rates. Jurors parking at the garage. DEC 23 2021.

Rates will vary and will be posted upon arrival. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. The current total local sales tax rate in San Antonio TX is 8250.

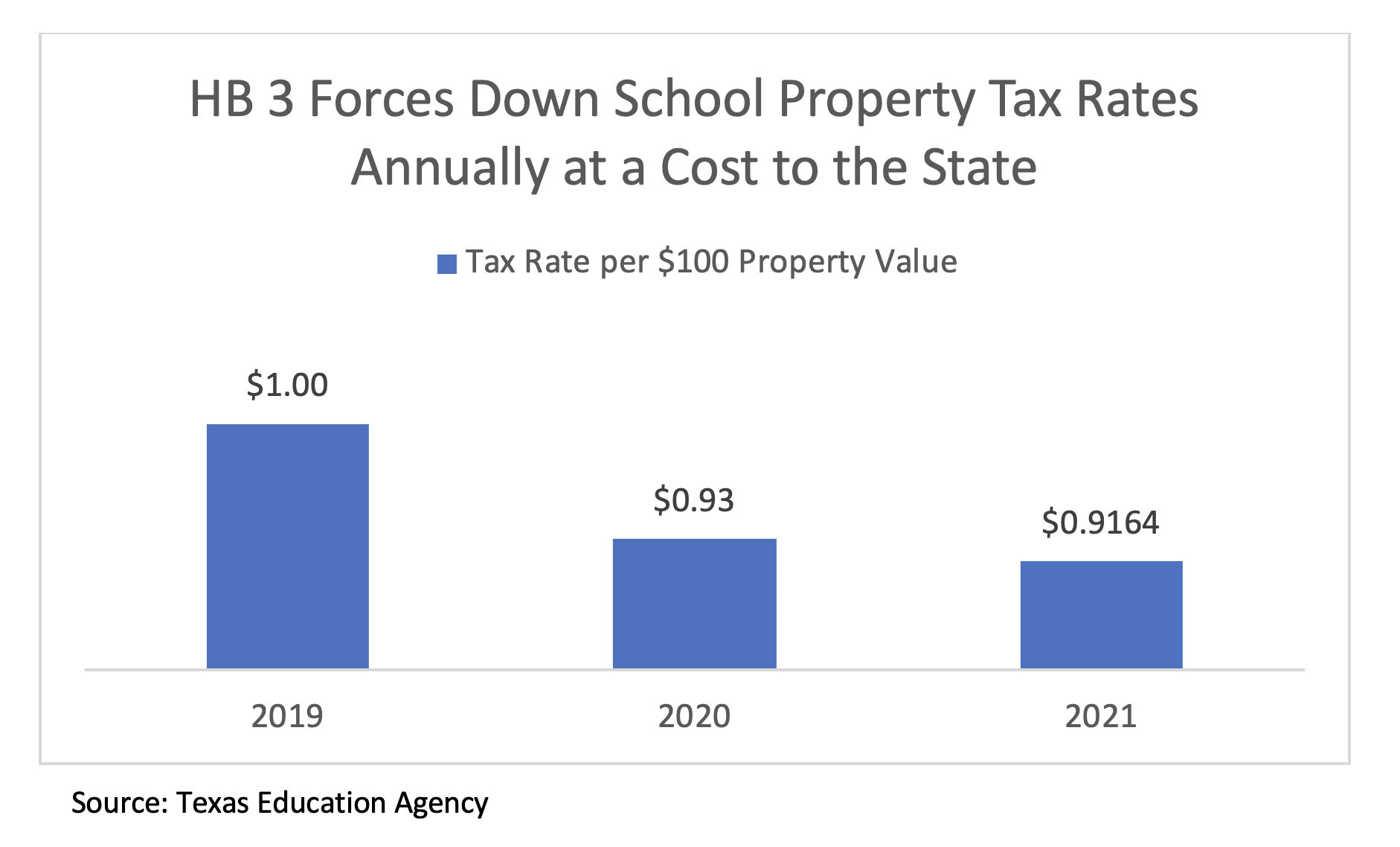

However the Texas Legislature in 2019. The minimum combined 2022 sales tax rate for San Antonio Texas is. PersonDepartment 100 W.

Overview of Texas Taxes. San Antonio TX 78205. Box is strongly encouraged for all incoming.

There is no applicable county tax. The Texas state sales tax rate is currently. Jurors parking at the garage.

If San Antonio wants to expand its current homestead exemption City Council must approve such a measure by July 1. The City of San Antonio plans to institute a. Outstanding Unlimited Tax Debt.

Rates will vary and will be posted upon arrival. 2021-2022 Debt Service Expenditures estimated 207897436. San Antonio TX 78283-3966.

City of San Antonio Print Mail Center Attn. Road and Flood Control Fund. The Texas sales tax rate is currently.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. This is the total of state and county sales tax rates. This city can afford to give more back to our.

City of San Antonio Property Taxes are billed and collected by the Bexar County. Tax unit 86 - timber creek annexed by the city of san. San Antonio TX 78205.

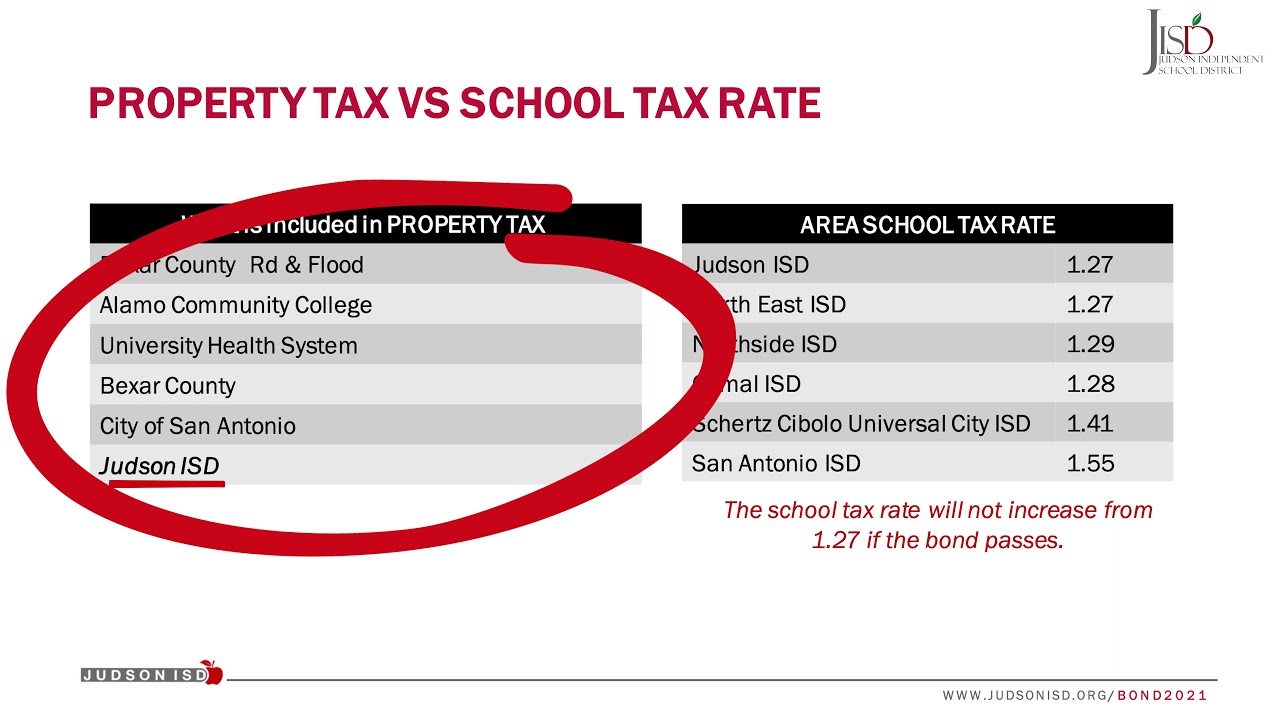

2020 actual tax rates 2021 actual tax rates as of 04112022 tax rates bexar county city of san antonio incorporated cities school. The minimum combined 2022 sales tax rate for Bexar County Texas is. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage.

The County sales tax. The sales tax jurisdiction. Jurors parking at the garage.

2021 total adopted tax rate. There are no cities in. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage.

City of San Antonio Taxing Unit Name 100 West Houston St San Antonio Texas 78205 Taxing Units Address City State ZIP Code Line e Form 50-856. Rates will vary and will be posted upon arrival. City of San Antonio Print Mail Center Attn.

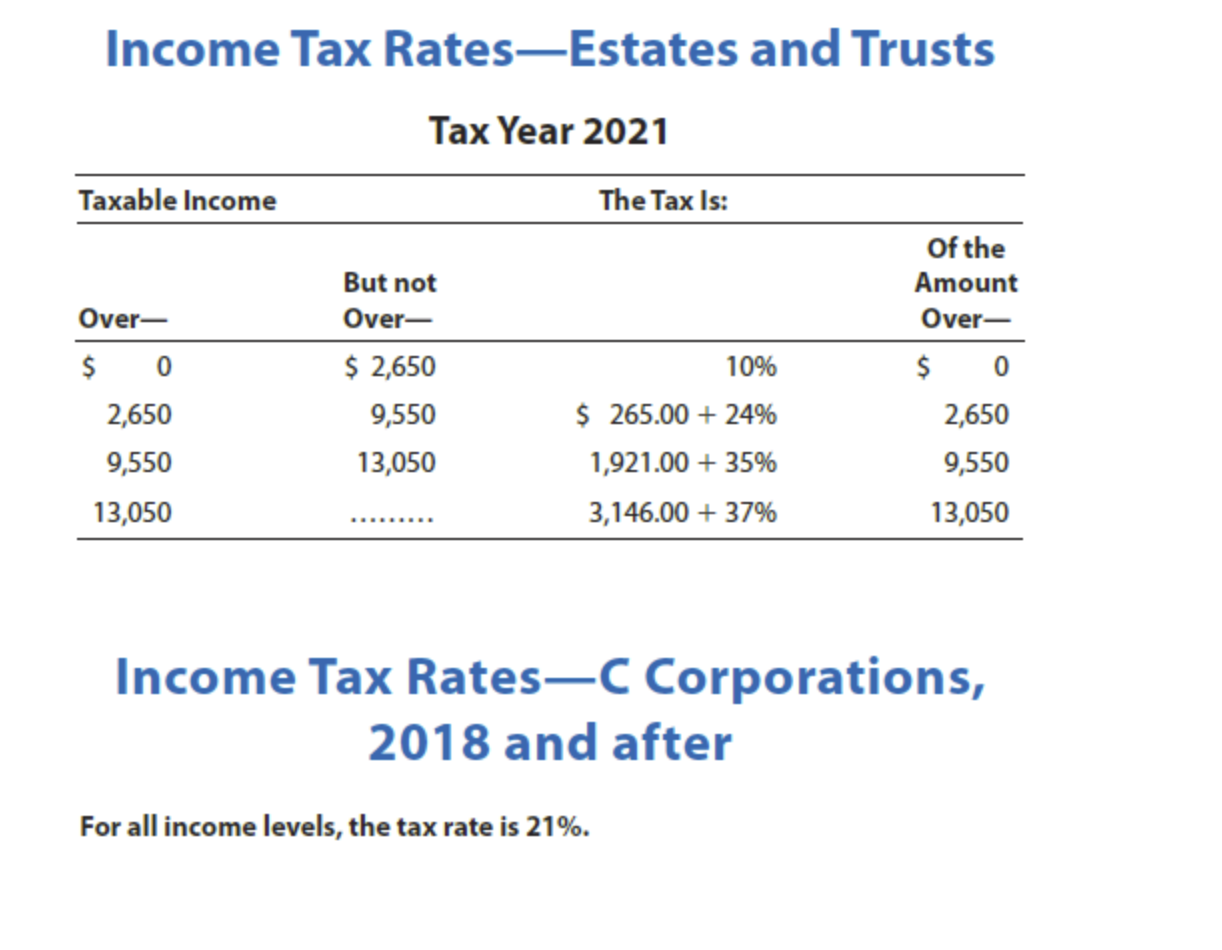

Monday - Friday 745 am - 430 pm Central Time. During the forecast period total General Fund revenue is expected to grow annually at rates than the FY 2021 Adopted Budget or an overall increase less than 01. Texas has no state income tax which means your salary is only subject to federal income taxes if you live and work in Texas.

2022-2023 Debt Service Expenditures budgeted. 2021 Official Tax Rates. Bexar County projects its net taxable base increased roughly 7 between 2021 and 2022 from 1927 billion to 2053 billion.

Mailing Address The Citys PO. San Antonios fiscal 2021 tax rate of approximately 056 per 100 of TAV provides ample capacity below the statutory cap of 250. Mailing Address The Citys PO.

This increase is primarily.

10 Things To Know Before Moving To San Antonio Tx

An Unstable Economy Is Not The Time For Tax Cuts Texas Monthly

Tax Rates Bexar County Tx Official Website

Most Texans Pay More In Taxes Than Californians Reform Austin

Budget Tax Notices Converse Tx Official Website

Elida Martinez Realtor San Antonio Did Your Home Suffer Damage From The February Winter Storm Tax Code Section 11 35 Allows A Qualified Property That Is At Least 15 Damaged By A

Current Facts San Antonio River Authority

Bexar County Budget Proposal Keeps Current Tax Rate

A New Division In School Finance Every Texan

Why Are Texas Property Taxes So High Home Tax Solutions

State Income Tax Rates And Brackets 2021 Tax Foundation

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Travis County Approves Fiscal Year 2021 22 Tax Rate Community Impact